Here is another resource for the math of perpetual energy savings through energy conservation :

http://www.financeformulas.net/Present_Value_of_Growing_Annuity.html

The present value of a growing annuity formula calculates the present day value of a series of future periodic payments that grow at a proportionate rate. A growing annuity may sometimes be referred to as an increasing annuity. A simple example of a growing annuity would be an individual who receives $100 the first year and successive payments increase by 10% per year for a total of three years. This would be a receipt of $100, $110, and $121, respectively.

The present value of a growing annuity formula relies on the concept of time value of money. The premise to this concept is that a specific quantity of money is worth more today than at a future time.

Like all financial formulas that involve a rate, it is important to correlate the rate per period to the number of periods in the present value of a growing annuity formula. If the payments are monthly, then the rate would need to be the monthly rate.

Let P = $1

r = 5

g = 10

n = 20

PV = $30.71, not $44! What is different? It is absence of allowing for inflation!

Here is a dollar growth chart through 20 years from my Excel file, setting zero inflation:

$30.71 through twenty years.

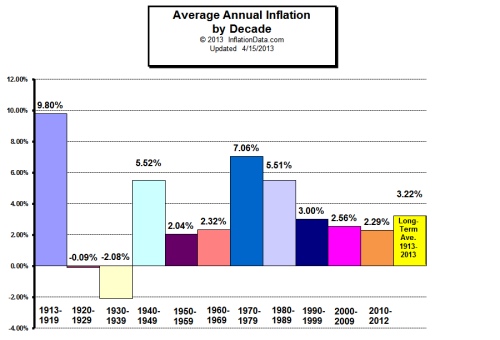

And $44 through twenty years at expected 3.22% annual inflation!

The Excel file, where cell definitions may be confirmed, and numbers may be read with table precision, is available for download at Google Docs:

https://drive.google.com/open?id=0Byj-qncyomXmZ0hKSERydlBkM28

The Excel file, where cell definitions may be confirmed, and numbers may be read with table precision, is available for download at Google Docs:

https://drive.google.com/open?id=0Byj-qncyomXmZ0hKSERydlBkM28

I will persist in applying a multiplier of 44 upon first-year savings for an energy conservation measure, to reckon present value of twenty years of savings. That is the additional pile of today's dollars one might hide away in an attic to pay for energy through twenty years, if he does not invest to save the energy. The newly-found calculator is deficient.

Inflation News

See then that inflation boosts the good news of savings through energy conservation. Copy in inflation data from the first post on perpetuity math :

Where inflation has lately been checked by monetary policy, expect we are in for a decade or more at much greater than 3.22% inflation, or even worse in expected investment banking collapse , seizing your savings, ruining present value of money. Expect a multiplier of much more than 44 upon first-year savings, for twenty year present value of savings in energy conservation. There is nothing better to buy with today's money, than a bit of energy independence.

Inflation News

See then that inflation boosts the good news of savings through energy conservation. Copy in inflation data from the first post on perpetuity math :

The pace of general inflation is expressed in the following chart:

Where inflation has lately been checked by monetary policy, expect we are in for a decade or more at much greater than 3.22% inflation, or even worse in expected investment banking collapse , seizing your savings, ruining present value of money. Expect a multiplier of much more than 44 upon first-year savings, for twenty year present value of savings in energy conservation. There is nothing better to buy with today's money, than a bit of energy independence.

No comments:

Post a Comment