Mad extraction of energy in rape of Alberta tar sands and fracking everywhere for oil and gas from shale, is surely investor-driven. It is not anywhere the act of some good hard-working producer, selling his honestly-produced wares, an "industry ." There are manufacturing industries. There are no extraction industries.

There may be a building products industry, done with sustainable draw and re-growth of resources. Extraction of materials with ruin, is only theft, and a materials purveyor little better than an evil creep encouraging and selling poached elephant tusks. Charles and David Koch don't run an industry. They only, are timber thieves and, in that, murderers of good people like Salvador Allende enabling free trade madness . So, I imagine them atop the list of investors wanting to sell off our limited public reserves of energy for consumption now and driving down prices, then wanting export-preference, to restore higher prices. But, is it only those without conscience in this tenth of the one percent?

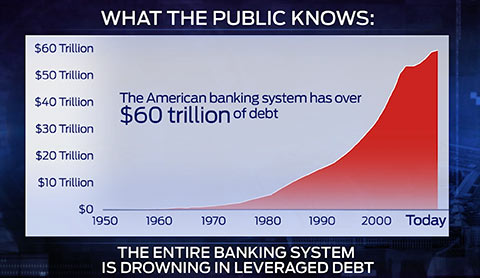

Go here , and be rightly scared if you are among the 99%. See what has been wrought by the greedy, goosed by 1999 elimination of Glass-Steagall restraints, damn you Bill Clinton.

I want to know who are the creditors of this debt. Are there hidden trillionaires lurking about? Holdings of The Government Of China, I understand, but a balance of payments problem does not accrue at this pace. Would some reader please explain this?

Then see what this greasy guy is wanting "investors" to do with hard assets of safely-buried energy, now stolen from our children and grandchildren for narrow self-protection of the privileged.

Here is advice leading to promotion of liquid natural gas for EXPORT. Anyone wanting hard-asset security and good returns might buy into and defend the crime. The awful creeps even sell fracking as the will of God , bestowed on blessed land owners; surely they must not resist.

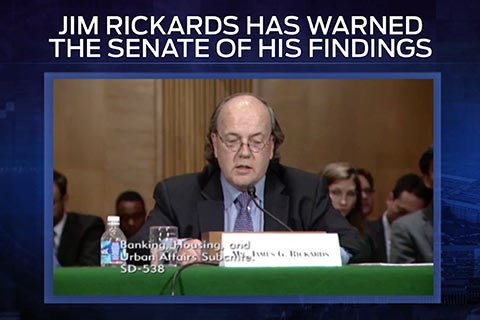

I'm not going to buy Jim Rickard's books. I have nothing in reserve but the hard asset of a partially-owned but very energy-efficient home. What will you do? Those readers responsible and paid to guard public interest in energy conservation, please find lessons to apply now. In Oregon, I have advised pulling public investment from the Wall Street gamblers. Everywhere, let us immediately create state banks to hold those public reserves and put them to good local use. Do we have enough time? A large and willing work force for weatherization will become available when a crash of world economies is timely. Let us be ready to engage them in secure investment of a small portion of the recovered and safe-guarded funds. Why not? Plans already underway will lessen the fall and speed recovery. We must not be resigned to twenty five year depression, accelerating, not fighting, the destruction of life on Earth.

Public officials especially, shall prefer the research of caring individuals, to the lies of scheming investors. What do those investors want? I think, to cash in at the back end on energy derivatives when truth and justice prevail, predictably. They don't care about any of us, further proof in schemes to drive up prices for their holdings of public resources, by exporting them, aided by bought government. And, all of this is part of a larger vacuum cleaner run by biggest insiders, that false evidence of prosperity floats a new real estate bubble, and more. Some cruelly inefficient homes, new, and especially old, are selling at record prices to people who should have learned a lesson. A trend like this for investors, is way beyond sustainable, lifted by lies and many trillions of dollars added national debt, in a weird new set of cycles:

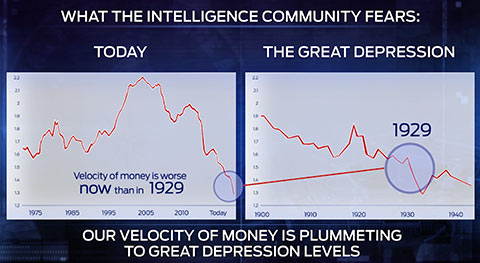

The next fall will be historic and irreversible. Another bailout of the investor-gamblers to continue the game, will be impossible. It will come. You know it. We all know it. Many poor people will die, in their inefficient homes. Regulators and public servants who had a duty to serve the public interest, might be remembered, and despised. Fighting on for homes in Oregon will be harder, where we were off course on dead-slow, and have now abandoned ship.

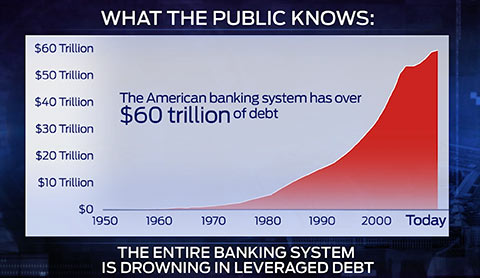

Please see a Yahoo! continuation of the above chart, to October 2014:

May anyone presume the indefinite future will be like the present?

Fracking has helped to build the precipice. Fracking has never been intended to maintain "prosperity," but only to enlarge the bubble. Some engineers of disaster believe they are in control, and gain more, the bigger the bursting bubble and the greater the chaos. It is to our shame, and the ruin of all, that hedge investing is legal, to cause and profit from collapse.

Here are writings of believable individuals:

Free Downloads:

http://www.sccma-mcms.org/Portals/19/assets/docs/fracking.pdf

Fracking Our Farmland, Our Families and Our Future: A New Toxic Legacy

Cindy Russell, M.D.

V.P. Community Health Santa Clara County Medical Association

Books, paperback or Kindle, at Amazon:

Snake Oil: How Fracking's False Promise of Plenty Imperils Our Future by Richard Heinberg (Jul 24, 2013)

Fracking Pennsylvania: Flirting With Disaster , by Walter Brasch (Feb, 2014)

At 8/17/2017, where this conversation is cited in comments to ACEEE, add this current chart of S&P 500. I think we have finally begun the descent.

In Oregon and all of the Pacific Northwest, I have played a role in discouragement of fracking investment through defeat of proposed coal, oil and gas export terminals. Yet the stock market madness grows to ever more terrifying heights:

DJI at 12/9/2017:

S&P 500 at 12/9/2017: